Foul Play: How the sinking Delta Corp drags competitors to the Bottom

Bookmaking service Delta Corp owes India’s government $2.9b in taxes.

Rapidly accruing debts and increased gambling tax are bringing down one of India’s major players of the online casino and poker market, Delta Corp. As a result of the company’s unfulfilled tax liabilities, its debts currently amount to Rs. 24 crore, or $2.87 billion, four to five times over the bookmaker’s value. State courts sided with the tax board. The company shares plummeted. To salvage at least something, Delta Corp resorted to selling off its array of online casinos. This looks very much like impending bankruptcy. And as the business owners try to resolve tax problems, the G2G website, owned by Delta Corp, evades paying advertising tax by publishing smearing pieces against its competitors, never bothering to label them as “ads”.

Dark days for Delta Corp

Delta Corp may not vanish by its 40th anniversary in 2025. For a company with around $120 million in revenue in 2022-2023, that owns and runs casinos in Goa and Sikkim states of India – in addition to an international casino in Nepal, and the largest Indian online poker website “Adda52.com” – these are some very dark days indeed.

The troubles began in September 2023: the GST Council served three subsidiaries of Delta Corp – Casino Denzong, Highstreet Cruises, and Delta Pleasure Cruises – with a debt notice of Rs. 11,139 crore, or $980m for a stretch of 2018-2022. The value of the company’s shares then dropped 48%, according to Live Mint.

Taxes go up, stocks plummet

Things took a turn for the worse in October. Raising the gambling tax in India was another blow to the company’s survival. GST Council revised the online gambling tax from 18% to 28% of the full-face value, effective October 1, 2023. Meanwhile, Delta Corp received another debt notice – Rs. 6,384 crore this time.

“The relative strength index (RSI) of Delta Corp stands at 26.9, signaling it’s trading in the oversold zone”, Business Today wrote in a report on the effects of the pressure on the company. Delta Corp’s shares had a one-year beta of 1.3 at the time, suggesting very high volatility over the recent period. The tax debt reached Rs. 23,206 crore, and the shares were selling at Rs. 140.

As of April 24 this year, their value has further dropped to Rs. 122.9. Obviously, the investors have lost a fortune on the company’s stock since the tax authorities ordeal. Indeed, starting April 2023, the value of Delta Corp shares has been cut in half, shrinking from 259.95 to 123 per rupee.

Anil Malani, Delta Corp Ltd President of Operations, confirmed the tax debts of the company reached Rs. 24,000 crore, or $2.9 billion.

Bookie sells off its company

The worst came to be in February 2024. According to Asia Gaming Brief, the parent company Delta Corp was bought out for debts for a sum of $9.6m. The piece continues in saying Delta Corp has made public the plan to dispose of its fully-owned subsidiary Caravella Entertainment Private Limited, which is in possession of 89,28% of Deltin Nepal Private Limited. Deltin brand owns a fleet of cruise liners with casinos operating onboard.

Delta Corp also made a deal to sell its shares of Ability Games Limited (Calcutta) and Ashtek Consultancy Private Limited for a total of Rs. 80 crore ($9.6m). This price includes the Caravella’s debt of Rs. 19 crore ($2.1m), along with share compensation of Rs. 62 crore ($7.4m). The deal was planned to over and done with on March 8, 2024. “Giving up its share in Caravella Entertainment, Delta Corp Limited seeks to optimize its portfolio and focus on its core objectives in line with its overall vision of growth and sustainable development”, said the company.

Courts side with taxmen

In one of Delta Corp’s lawsuits against the tax authorities to terminate the tax demand, the Bombay High Court dismissed it at the end of February, and the tax authorities’ claim against Delta Corp remains pending. Another similar claim is still under consideration in the High Court of Calcutta.

Delta Corp attacks competition via G2G site

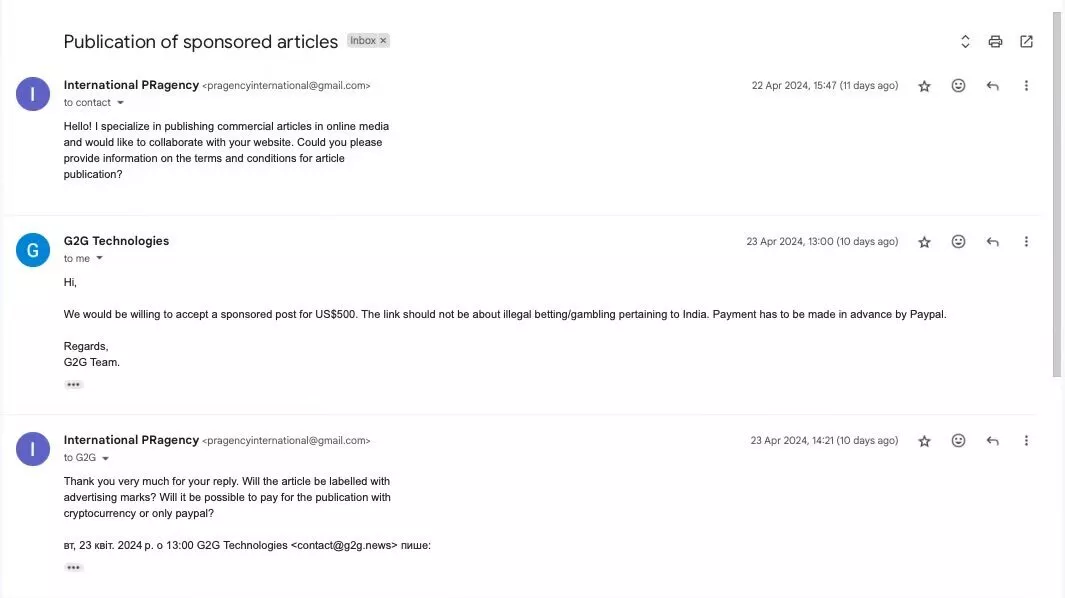

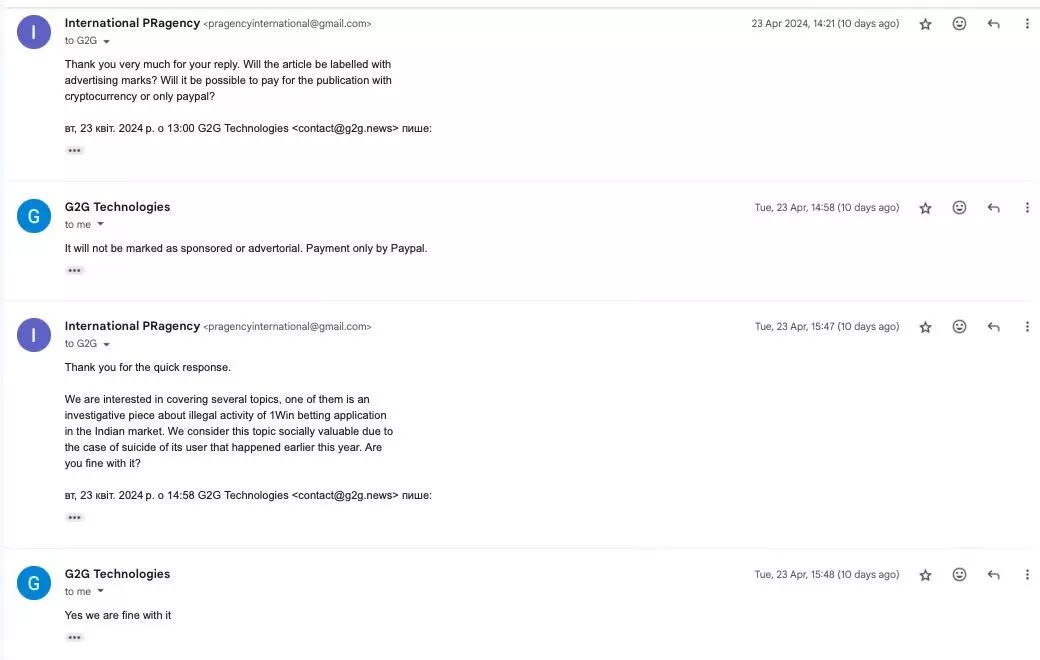

As the Delta Corp owners sell off their assets and try to stay in the court fight, the g2g.news website – owned by G2G Technologies Private Limited (Goa, India), and controlled by the parent company Delta Corp – puts up nasty pieces about the competitors for money.

There’s ample proof in the chat with the PR company that attempted to commission a revealing article from g2g.news. Turns out, it’s easier than one might think it would be. All you have to do is shell out $500 – and the journos will make sure that any market player becomes the most vile, corrupt scoundrel in the country.

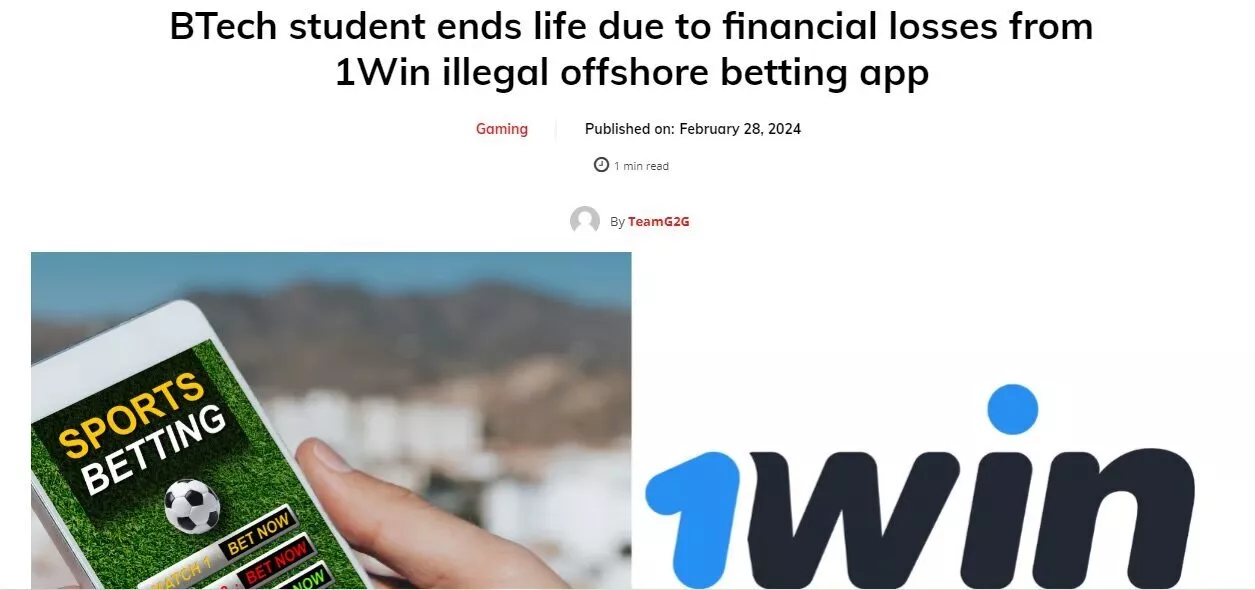

This here, for example, is how 1Win, the competitor, has become a devious monster that pushes people to the brink – thanks to g2g.news.

Moreover, the client has an option to have their orders carried out “off the books”, without labeling the articles as advertising. Bottomline, India misses out on advertising tax money, as the owners are pleased with yet another tax exemption and elimination of competition.

With all the data laid out before you today, do you still believe Delta Corp is an upstanding taxpayer, and all the accusations of tax evasion are untrue?